Forex copy trading is a popular method of trading in the foreign exchange market that allows traders to imitate the trades of experienced investors. This method is gaining traction due to its simplicity and the possibility of consistent profit generation. Whether you’re a novice looking to step into the forex market or an experienced trader seeking an additional strategy, forex copy trading World Forex Brokers can provide you with the necessary tools and insights. In this article, we delve deeply into the concept of forex copy trading, exploring its benefits, potential risks, and steps on how to get started.

What Is Forex Copy Trading?

Forex copy trading, also known as social trading, involves following the trading strategies of other, more experienced traders. Essentially, when you copy another trader’s actions, any trades they execute in their account will also be reflected in yours, proportionally based on the amount you allocate to copying them. This allows you to leverage the skills and expertise of seasoned traders without needing to fully understand the market yourself.

How Forex Copy Trading Works

To engage in forex copy trading, you typically need to use a broker that offers this service. Here’s how it works in a nutshell:

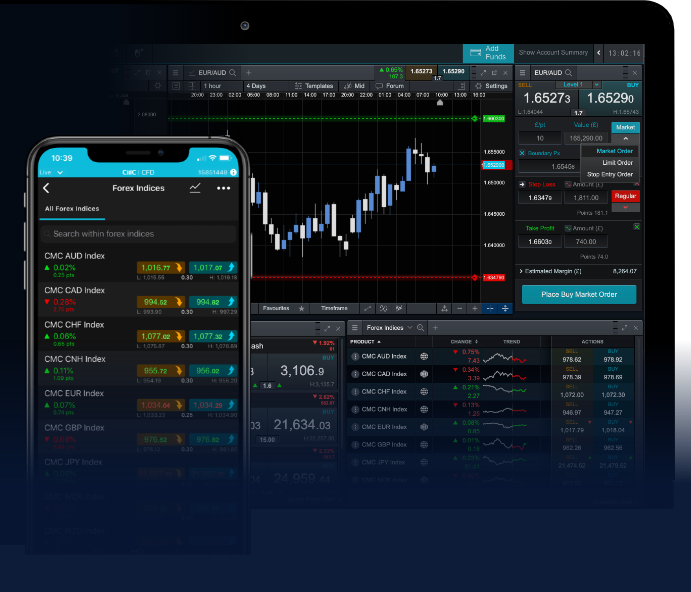

- Choose a broker: Start by selecting a forex broker that provides copy trading services. Make sure to research their reputation, fees, and available trading platforms.

- Select traders to copy: After registering, you will have access to a list of traders along with their performance metrics. This information is crucial for assessing who you might want to follow.

- Allocate your capital: Decide how much of your investment you want to allocate toward copying selected traders. It’s common to diversify by copying multiple traders.

- Monitor performance: Once your account is set up and active, you can review the performance of your investments and adjust your choices accordingly.

Benefits of Forex Copy Trading

Forex copy trading offers several advantages, making it attractive for both novice and experienced traders:

- Accessibility: It lowers the barrier to entry for new traders, allowing them to participate in forex trading without extensive knowledge or experience.

- Time-saving: Copy trading is less time-consuming than traditional trading since the copying trader does the analysis and execution of trades.

- Diversification: By following multiple traders, you can spread your risk across various strategies and trading styles.

- Learning opportunity: You can learn from the strategies and methodologies of successful traders while you copy their trades.

Potential Risks Involved

Despite its benefits, forex copy trading comes with its own set of risks:

- No guaranteed returns: Just because a trader has performed well in the past does not guarantee future success. The forex market is highly volatile and unpredictable.

- Dependence on others: Your performance is tied to the traders you choose to follow. If they make poor decisions, your account will be affected.

- Overtrading: Some traders may take excessive risks or trade more frequently than is advisable, which can lead to significant losses.

How to Get Started with Forex Copy Trading

If you’re ready to begin your forex copy trading journey, follow these steps:

- Research potential brokers: Look for forex brokers that offer copy trading platforms. Consider their fees, reputation, and available tools.

- Register for an account: After choosing a broker, you’ll need to open an account. This process typically includes providing your details and verifying your identity.

- Fund your account: Add capital to your trading account. Make sure you only invest money that you can afford to lose.

- Browse and select traders: Explore the profiles of various traders on the platform. Pay attention to their trading styles, risk levels, and past performance statistics.

- Start copying: Allocate your funds to copy the selected traders and start monitoring your account’s performance.

Strategies for Successful Copy Trading

To maximize your success in forex copy trading, consider the following strategies:

- Diversify: Don’t put all your capital into a single trader. Instead, diversify your portfolio by following multiple traders with diverse trading strategies.

- Stay informed: Even though you’re copy trading, it’s beneficial to stay updated on market news and trends to understand the context of traders’ decisions.

- Regularly review and adjust: Periodically assess the performance of the traders you’re copying. If someone is consistently underperforming, consider reallocating your funds.

- Understand the risks: Be aware of the inherent risks associated with forex trading. Only invest what you are prepared to lose.

Conclusion

Forex copy trading can be an excellent way to enter the forex market, especially for those who may not have the time or expertise to trade independently. By leveraging the skills and strategies of established traders and using a reliable broker, you can potentially enhance your trading experience and profitability. Nevertheless, it’s essential to be aware of the risks involved and to approach copy trading with a strategic mindset. With careful research and ongoing review, forex copy trading could be a valuable addition to your investment strategy.